Warby Parker finds itself in a place right now it has never been before. The famed eyewear brand is used to posting nothing but wins on the scoreboard, including billion-dollar valuations and Fast Company’s nomination as the most innovative company on earth. But for the first time in Warby Parker’s 10-year run, the wind is no longer at its back. Like all its peers hacking through the interminable weeds of COVID-19, it has been forced to close stores and furlough staff.

And yet a sea change is already underway, a movement to reignite operations where Warby Parker seems once again ahead of the pack. From his home on Long Island, Dave Gilboa, the company’s co-founder and co-CEO, discusses how Warby Parker is reopening, why it may actually pursue more retail space (not less) going forward, and the new stakes for retailers to make it known they are a clean and sanitary place to shop.

“Until there's a vaccine,” he says, “there's going to be a massive differentiation between those companies and those brands that show they take health and safety as the number one priority—versus those that don't.”

(This interview has been edited and condensed for clarity.)

On Mar. 14, Warby Parker closed all 120 of its retail stores across the United States and Canada. Some two months later, a handful of your stores have now reopened, and I understand another select batch is about to open, too. What is it like at these stores now compared to the beginning of 2020?

Gilboa: The experience within the four walls of our stores is dramatically different for both our team and for our customers. We're still able to serve customers effectively, but we've instituted new safety protocols in every aspect of the shopping experience.

The first thing that you'll notice as a customer is that we're limiting the number of people that can enter the store at any given time. Pre-COVID, you used to be able to just roll right in, kind of choose your own adventure in that store. You could go to any part of the store, try on any pair of glasses, talk to any of our team members, interact with other customers as you saw fit. Now, we have a more controlled experience to ensure the health and safety of everyone.

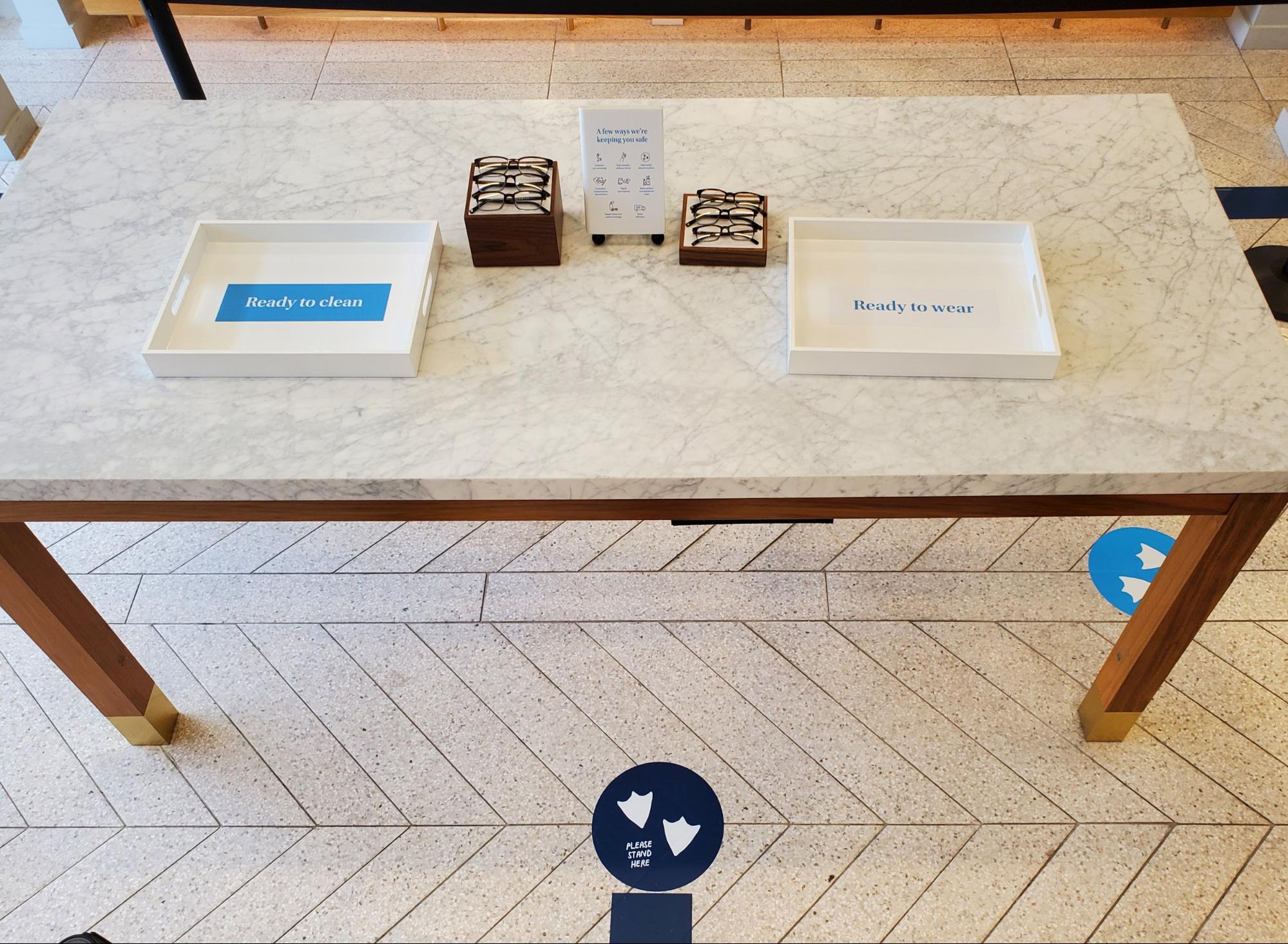

Every customer who walks in is paired with one of our retail advisors, so it's a one-on-one guided shopping experience. We have vinyls on the floor to indicate the path that customers should progress through the store. We've changed the merchandising of a lot of our frames, so that we can have multiple customers looking at the same glasses, but at different parts of the store. That enables us to have customers that are shopping but still more than six feet apart from anyone else in the store.

With the one-on-one guided experience, our retail advisors disinfect every frame before and after a customer tries it on. Our employees and customers are all wearing masks. Our team goes through a daily health screening before they enter the store, including mandatory temperature checks.

Over the last few weeks, our team has also rebuilt all the technology that's used to serve customers in the store. We've created contactless payments, contactless measurement devices, digital intake forms. When you're paying for a pair of glasses or contacts, instead of handing our team your credit card, we're able to scan that [payment] information using a camera. Instead of our team using a pupilometer, which looks like a pair of binoculars to get your pupillary distance measurement, we're able to take that measurement using an iPad or an iPhone camera—and [even] do so remotely.

And instead of filling out any paper forms, we've created digital intake forms that we can email or text to you that you can fill out on your own device. So our team has really rapidly adapted to this new environment to ensure that we're able to serve customers effectively, but do so safely and with as little contact as possible between customers and our team, and customers with one another.

A statement on your website reads that Warby Parker would reopen a small number of stores initially “where we're able to ensure a safe shopping experience for our team and customers." What criteria made these stores right to be the first in your company's stable to reopen?

Gilboa: We've put together a robust safety framework that includes a number of different factors. The first thing is we look to state and local governments to understand: Are there any restrictions in these geographies? Are there recommendations from the government?

We've combined that feedback we're getting from governments with a number of other factors, including tracking how impacted the region is in terms of the number of COVID cases, number of hospitalizations, fatalities, the hospital capacity, the number of open hospital beds, the number of open [intensive care unit] beds, and how those numbers are trending—both the absolute levels and where we can expect some of those numbers to trend over the coming days and weeks.

And then we also look at the type of store that we're operating. Is it in an indoor mall location where we don't have as much control over ventilation—we don't have as much control over shared surfaces that our customers might be touching—versus an outdoor street location? We take all those factors in combination, along with qualitative feedback that we're getting from our team on the ground who lives in those cities and lives in those neighborhoods.

That's how we decided to open our first seven stores, and we're tracking every county that we have a store in across the U.S. and Canada. We're tracking metrics on a daily basis to try to understand which regions are likely to be safe to operate stores, and which [regions] we will continue to wait until we see data that indicates better levels of safety.

You've mentioned some pretty drastic changes to the retail experience here—necessary changes, but drastic changes, nonetheless. From what you've learned in just these few short weeks since reopening, what new things do you believe are here to stay for the long run when considering retail shopping as a whole?

Gilboa: We believe crises tend to accelerate existing trends, and that this one is no different.

We believe that there's going to be a step function increase in ecommerce adoption within the eyewear category. We think that's going to be true of every other category, [too].

Now, physical retail is still going to have a massive part in the overall economy. Humans are social animals. Humans like trying products on. They like touching them and feeling them and engaging in the real world—not just through digital means.

We're still really bullish about physical retail, but we do expect ecommerce to play a larger part in how people shop. We're finding a lot of our customers that have bought from us over the last few weeks had never bought Warby Parker glasses online. Those customers will continue to think, for their future purchases, about ecommerce as a viable option for them, and will likely tell a lot of other people about their experience. We think that there will be an acceleration in that adoption.

You mentioned in an interview this idea that shoppers are going to be put at ease by cleanliness in stores. To paraphrase your words: Retail clerks don't need to be in hazmat suits or anything like that, but shoppers are going to at least feel more comfortable seeing sanitizing wipes and actually viewing employees wiping down surfaces.

What is your best guess at how long this lasts, and perhaps even becomes a differentiator for attracting shoppers into stores going forward?

Gilboa: We think these new health and safety protocols are going to be in place until there's a vaccine that's available to every single person on the planet. And we think that it's still a ways away.

Even on the other side of that, even if everyone is vaccinated against this disease, I think there's still going to be heightened awareness around the fact that there are these communicable diseases that are easily spread by people breathing and coughing and sneezing on each other.

If you look at what's happened in countries in Asia that have been impacted with SARS and other diseases quite some time ago, they've developed a culture around mask wearing and sanitization, and it's commonplace for temperature checks. I think you're going to see a drastic change and a drastic increase in tolerance.

People are going to welcome a lot of these safety measures. Until there's a vaccine, there's going to be a massive differentiation between those companies and those brands that show they take health and safety as the number one priority—versus those that don't. It's going to be a massive competitive differentiator for where people want to work and where health and safety is going to be top of mind for everyone. And it's going to be a big differentiator in terms of where customers are willing to shop.

I don't think anyone really knows how consumers are likely to rebound from this as the economy begins to open up again. I've read plenty that people will be tight-fisted with their cash. We saw a few examples in Asia in the early days of stores reopening where a certain segment of shoppers were dying to throw their money at any luxury boutique that would take it.

What is your sense, either informed by the few weeks you've had back open at Warby Parker or not, of how consumers are going to be spending their money this year?

Gilboa: We [initially] found that the majority of our buyers have been purchasing out of necessity where they need a new pair of glasses. They lost their only pair. They had to pack up in a rush and go somewhere else. Their prescription has changed. Someone sat on their glasses.

[But] over the last couple weeks, we've seen more discretionary purchasing, where people are buying bolder styles, different colors. We're hearing from more and more of our customers that they're spending so much time in front of their computer on Zoom calls. They might not be wearing pants, but they want to make sure that they can have a new pair of glasses that everyone is seeing. We've seen a noticeable change in discretionary spending.

We think companies are going to continue to be impaired in a meaningful way in a variety of different industries. It's a bit of a head-scratcher for us as we look at some of the trends in employment, and as we talk to other CEOs. Seeing the stock market is still close to record highs, and [there] doesn't seem like there is too much concern about the mid- to long-term viability of the economy.

I think we have a very bumpy road ahead. And some of the really negative impact in terms of consumer spending hasn't been felt yet, because people either are able to rely on some savings that they had, or rely on government stimulus that is going to run out at some point.

This has been a challenging time for many retail companies, and of course direct-to-consumer (DTC) brands have not been spared. If you'll allow something of a crude comparison here, we've seen very hip, very popular young companies like yours that are disruptive in their segment—brands like Everlane, Away, Ministry of Supply—have all gone on record as having revenue decreases of late, in some cases drastically.

Your company has been transparent that you've had to furlough portions of your retail and customer experience teams, though I imagine perhaps some of that is reversing now or may soon. How is Warby Parker doing financially right now?

Gilboa: We've had to make some of the toughest choices that we've ever had to make as a business. For the first time, we faced a decision of temporarily parting ways with some of our team members by putting them on furlough. When facing an uncertain period ahead we knew was going to dramatically negatively impact our sales and profitability as a business, we wanted to make the right long-term decision but also treat our team members well.

For our retail team members and [customer experience] team members that we furloughed, we put a retention program in place, where we committed to make them whole when we bring them back. And we've already brought back a number of those team members, [and] hopefully will bring back the rest of them very soon as we continue to open stores.

But all of a sudden, we are faced with a balance sheet that we thought was bulletproof in any reasonable state of the world, including some severe downside scenarios. But we couldn't have predicted a pandemic, and I don't think many companies did.

We feel fortunate that we continue to have a healthy balance sheet, that our business is rebounding. We have supportive investors that have committed to step up and ensure that we have the capital that we need as a business. There have been some heart-wrenching moments, as we've tried to balance what makes the most sense from a business perspective with treating our team with the values that we've established as an organization.

Is it too great an oversimplification to suggest that the number one factor for companies and brands to weather this crisis has been cash on hand?

Gilboa: Certainly, 100% of businesses fail because they run out of cash. I'd say it's been a combination of cash on hand plus ability to obtain new cash. That second component, I think, has been highly variable depending on the type of business and what [its] future prospects look like.

For a business that was operating with a thin balance sheet, but all of a sudden they're seeing their business go through the roof because they're a telemedicine company—it would be pretty easy for them to raise capital. If it was a business that had been loaded up on debt with 1,000 stores and no ecommerce presence and a pretty dim future in this environment, no one is going to give them cash on reasonable terms. The existing state plus future state [of a business] is the formula to indicate where your cash position could end up on the other side of this.

Warby Parker has an optical lab facility about an hour outside New York City (pictured above), though of course the bulk of your manufacturing is done in places like Italy, Japan, and China. What's been the most difficult part during this crisis of running a global supply chain like that?

Gilboa: It's been fascinating to follow the spread of COVID-19. When we were in the early days of the outbreak, our biggest concern was our Asian suppliers—the factories that we work with in China, and then in Japan, [but] then [also] quickly in Italy. We wanted to make sure that we still had our supply chain partners, we were keeping their teams healthy, they were able to operate, [and] that we would have continuity from an inventory and a business standpoint.

Initially, our inclination was: Let's pull forward as much inventory as we can, because we don't know what the global impact of this disease is going to be. That quickly shifted once the outbreak really started in the U.S. to think about our team and the health and safety of our own team and customers.

With our optical lab in Sloatsburg, specifically, that has been deemed an essential business, so we have been able to operate that through this entire pandemic. It's been really important to enable us to continue to serve customers during this critical time and make glasses and ship them out to customers when they don't have many other options.

We've kind of changed every part of that operation. We unbolted and moved production lines so that employees could work at least six feet apart from one another. We instituted mandatory mask and glove wearing, and daily symptom checks, including daily temperature checks. We have mandatory hand washing. We’ve staggered our lunches, and separated the team into multiple teams that enter and exit the facility through separate entrances, so that if we did have any positive cases and we did have to quarantine a portion of the team it wouldn’t bring the entire facility to a halt.

The team has responded really well. Everyone understands why these things are important. They feel safe coming to work most importantly. It's allowed us to continue to ensure that our business is up and running while maintaining these health safety standards for our team.

Of these relatively young, really resonant DTC brands like we mentioned earlier, Warby Parker is at or near the front of the pack in terms of your retail presence. I'm nearly certain most of these brands we talked about are nowhere near the 120 store count that you can lay claim to.

I meant to ask you today how you view the company's decision to so actively pursue a growing store count in light of how COVID-19 has changed things. But in fact I saw you on CNBC talking about how Warby Parker is excited to sign new leases and still expand its retail footprint. Can you share with us to look into the considerations, in either direction, about retail that you've made during this crisis?

Gilboa: We don't regret for a moment rapidly expanding our retail footprint. We will be eagerly reopening all of our stores hopefully in the coming weeks, although we'll continue to monitor when it's safe to do so.

On the other side of that, we'll be excited to sign new leases, and we think that, out of this crisis, there are going to be really great deals that we'll be able to broker with landlords. There are going to be some companies that need more space, and we'll be one of them.

The footprint of our stores might increase. That would allow us to have more flexibility, and have a greater number of customers in our store while maintaining a safe physical distance. There's no question that we want to continue to expand the number of eye exam rooms that we have.

Some of the specific tactics around our store rollout, the speed at which we open stores—that footprint might look a little different. The overall strategy around creating a convenient shopping offering for our customers will not change.

Your stores today exist primarily in the United States, with an additional three so far in Canada. In your head and in your dreams, what does the ideal map of Warby Parker store locations look like worldwide to you?

Gilboa: We started Warby Parker with the goal of creating one of the most impactful brands in the world 100 years from now. We have a very long time horizon on everything that we do. We fully expect to be a global brand one day.

At the same time, one of the reasons that we've had success to date is our focus. The global eyewear market is over $120 billion. About a third of that is in the U.S. So we still have a ton of opportunity within our core market, and we'll continue to focus within North America for the next few years.

You mentioned earlier the deliberations about opening new stores may have slightly changed for you over the past couple months. What new things when considering a new location do you have to think about now?

Gilboa: I think we're going to revisit some of our assumptions around the optimal size of a store. We've really benefited from having small footprints with a lot of density and a lot of transactions per square foot.

Going forward, we might want to have bigger stores, where we can ensure that there are more customers that can safely shop without getting too close to one another. We'll be designing stores for flexibility. We want to make sure that we have enough flexibility and agility to redesign our stores as we need to.

We'll also probably take a fresh look at the mix between indoor mall locations, outdoor lifestyle centers, and outdoor street locations [to] determine if we think that indoor malls aren't going to be as safe an environment for our team and for our customers. Or if people are going to feel more comfortable shopping in other types of environments.

Let me wrap up here with a few short things here, some items are a little more personal to you. You serve as a founding member of the entrepreneur board of Venture for America, which is an organization that works to help young graduates become entrepreneurs.

Maybe you've had this talk already with somebody or maybe you haven't yet, but how would the advice you'd give to a young entrepreneur change now versus what you might have said even three, four months ago?

Gilboa: Crises force focus. In a world that we're entering—where capital is probably going to be a bit harder to raise, where there's going to be less tolerance for side projects—[I] would really encourage any entrepreneur to focus on what matters most. And that is solving real problems and really understanding their customers and the problems that they're solving for those customers. Really pushing out everything else to the side.

That is probably good advice in any era, but certainly the one that we're facing is placing a premium on ensuring that startups or companies are really creating value and solving problems for their customers.

Sometime recently, I was speaking with Uri Minkoff, who's the co-founder and CEO of Rebecca Minkoff, the fashion label. Uri is a guy who is big into tech, and they really go into great pains to make their in-store experiences special.

I asked Uri, "As somebody who obsesses over this kind of thing, what are some other brands you look at and say are really doing retail right, too?" And, wouldn’t you know it, he paused for just a very brief moment and said, "Warby Parker."

I want to pose that same question to you, Dave. When you're out shopping around, or maybe even doing competitive research into what kind of things you like or don't like for your own stores, what other brands do you really like for what they're doing in retail?

Gilboa: A brand that we have a ton of respect for is Allbirds. In a lot of ways, they have been on a similar journey to us. They started online. Now, they have opened a bunch of stores. I think they've done a great job of bringing their core identity and their core ethos to life in those stores, where sustainability is such a big part of their brand and materiality.

Walking into one of their stores, whether it's in San Francisco or New York, they have brought a tactile experience into the shopping process of [displaying] wool and highlighting a lot of their sustainable materials. The shopping process itself is quite efficient, but there's also storytelling that they’ve brought into the in-store experience.

Last one, and it's a little bit in the same vein. I've got in front of me a list of Fast Company’s Most Innovative Companies of the year. So, 2012: Apple. 2013: Nike. 2014: Google. Any guess who came out on top in 2015?

Gilboa: I believe it was us.

That's right: Warby Parker. And names like Amazon and Snap have come since. So some really good company, obviously, for Warby Parker to be in there. Who are some other candidates you think fit that criteria these days? Who strikes you as companies whose innovation really appeals to some of the things that Warby Parker still aspires to be?

Gilboa: Not to brown-nose, but we have a ton of respect for what Shopify has been building, and the pace of innovation and additional features and value that they continue to add to the platform. Whether that is bringing in fulfillment tools for a lot of the brands on the platform, or new payment options or financing options to really help support merchants.

In the same vein, Stripe is a company that continues to be super impressive. We're a Stripe customer and happy as a customer of theirs. They're continually thinking about how they can make it easier for new brands to launch and set up payments. We're inspired by a lot of these companies that are able to build ecosystems to really make it as easy as possible for entrepreneurs to spin up brands and connect with customers, and create value to the world.